How Credit Unions Can Leverage AI to Fight Fraud

A 65-year-old man gets a call. It appears to be from his credit union, alerting him to potential fraud on his account. He’s told he should be receiving a text message with a code and that he needs to share that code with the person calling to verify his identity.

What he doesn’t realize is that it’s a fraudster on the phone who is trying to create a Zelle account in his name and link it to his checking account. It’s weeks before he checks his statement and realizes that money has been moved from his account in a series of Zelle transactions.

Although this is a hypothetical fraud scenario, true stories like this are all too common. And they represent a key challenge in fighting fraud.

Financial institutions have been devoting a significant portion of their budgets to identity verification to fight fraud and plan to boost that investment going forward, according to Regula and Sapio research. However, criminals can get around those security measures by taking advantage of the weak link in the system: your member. The right story can persuade credit union members to hand over account information to fraudsters and authorize transactions.

Artificial intelligence is making it even easier for criminals to make their stories appear legitimate. When generative AI can impersonate people, relying on increased identity verification alone to fight fraud isn’t enough. It requires consumer vigilance and an always-on second set of eyes on their accounts to catch changes in transactional behavior.

Although AI is helping fuel fraud, it can be part of the solution. And it doesn’t have to be prohibitively expensive or difficult to implement. Market-ready solutions can provide highly effective fraud detection at a low cost.

Detecting changes in behavior

AI has been used by financial institutions for fraud detection since the late 1980s, typically relying on large datasets to create models to flag anomalies. With scammers creating personalized scams, credit unions need to tailor protections to individual members rather than relying on general solutions.

Effective AI fraud detection systems learn what is normal behavior for the individual credit union member. They know how much money comes into the account each month, when it comes in, when it goes out, where transactions are typically made—not just a geographic location but specific retailers, service providers and transfers to other accounts. They recognize when new accounts are linked to existing accounts, when out-of-the-ordinary P2P and A2A payments are made, when one-time donations become recurring, when weekly or monthly charges increase, when cryptocurrency is purchased.

When effective AI monitoring systems catch changes in behavior that might otherwise go unnoticed, they immediately send up a red flag. They enable account holders to stop fraud and limit losses. Effective personalized monitoring also adapts to the newest scams. It can recognize when behavior changes reflect trends that align with emerging fraud tactics and alert account holders to threats.

Catching concerning patterns

Combating fraud requires looking beyond credit union members’ checking and savings accounts. It takes an integrated approach that monitors all aspects of their financial lives to detect concerning patterns.

Consider the hypothetical 65-year-old fraud victim referenced above. Assume he had signed up for credit and identity monitoring and was notified that his personal information had been compromised in a data breach. He knew to be on the lookout for scammers calling or texting because his phone number was circulating on the dark web.

An effective AI fraud detection system combines checking and savings account monitoring with credit card account, investment account, credit report and identity monitoring. It can alert credit union members to signs that their identity has been stolen or that fraud has occurred in other accounts, helping them ward off potential fraud in their credit union accounts.

Combining AI-monitoring with human support

AI monitoring can be especially effective in fighting fraud when it’s combined with human support. Older adults, in particular, can benefit from having a trusted family member with view-only access to their accounts and the ability to receive alerts when AI monitoring catches unusual activity. If the older adults don’t recognize the need to respond quickly to alerts, their trusted loved ones can intervene quickly to help.

Plus, a system with dedicated human care agents to guide account holders through next steps when they receive alerts can improve outcomes. This component in the fight against fraud can’t be overlooked, especially considering that credit unions pride themselves on supporting their members.

A market-ready solution

Developing an in-house AI-driven fraud detection system could take years and eat into limited credit union budgets. That’s why partnering with a trusted provider that offers an easy-to-implement system can provide a low-cost way to deliver an effective solution.

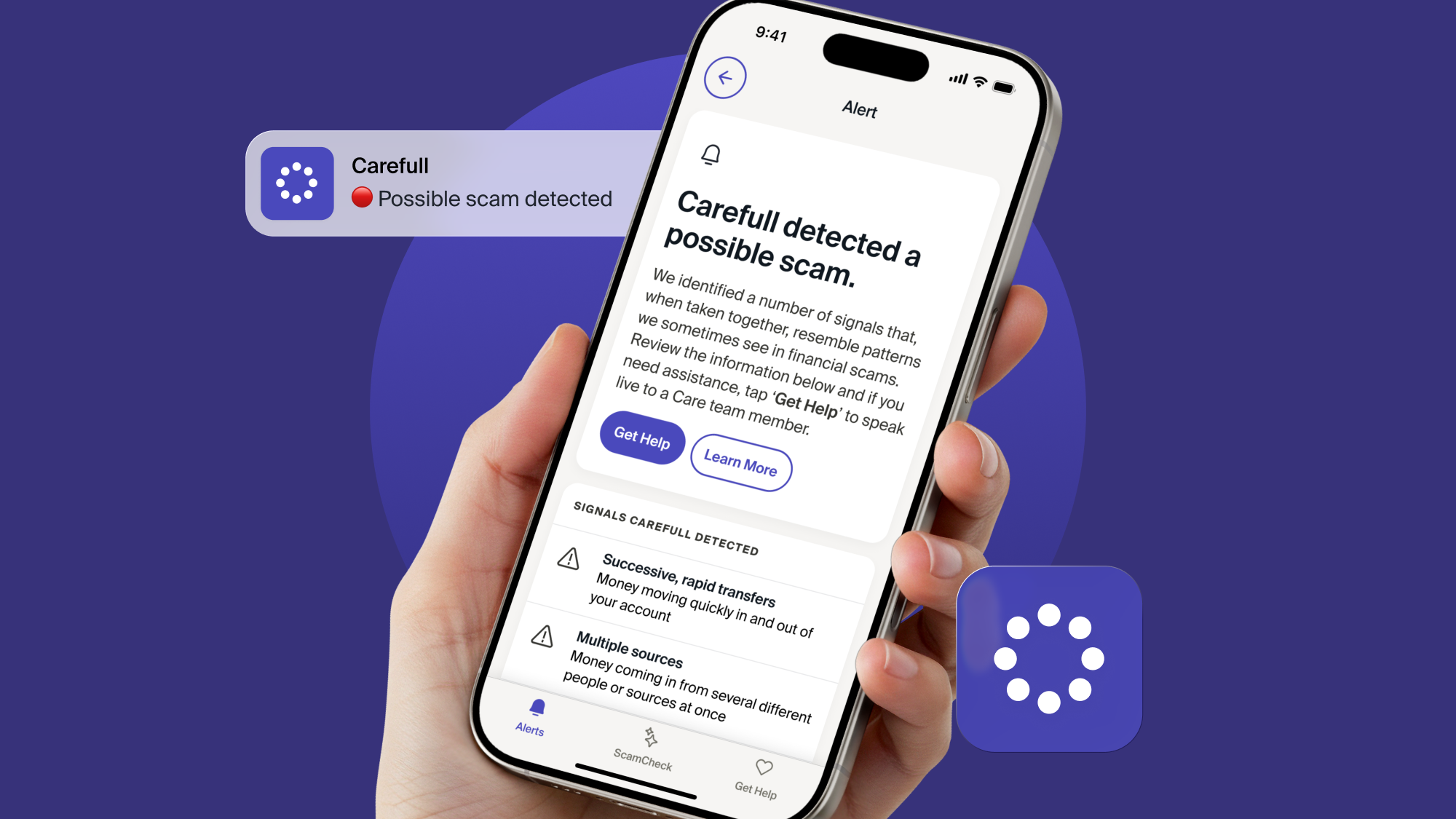

Carefull partners with credit unions to protect their members and customers with its AI-driven technology. It monitors financial accounts, credit and identity 24/7 to determine what is normal and detect changes in transactional behavior to alert members to unusual activity, signs of fraud, the latest scams and misuse of their personal information—backed by $1 million in identity theft insurance.

Carefull allows for coordination with family members with its Trusted Contacts feature. And its U.S.-based Care Agents are available to answer questions, provide technical support, and help users resolve any issues detected by Carefull’s account, credit and identity monitoring.

To learn more about how Carefull can help your credit union protect its members against fraud, get in touch with our team.

3 Steps to Safer Money,

Try it Free for 30 Days

Step 1

Start your free,

no-risk trial

Step 2

Connect the accounts and cards you want protected

Step 3

Stay alerted to any

unusual activity