Researcher Says Financial Institutions Can Protect Account Holders with Dementia

Numbers don’t lie. And what the numbers in a landmark study show is that financial mistakes can be an early predictor of dementia.

For financial institutions, the study suggests that they are in a position to see the warning signs in financial transaction data years before doctors typically detect cognitive decline. It does not imply, though, that they should be attempting to diagnose dementia among account holders.

“I think financial institutions can protect older adults without getting anywhere close to playing doctor,” said Joanne Hsu, a researcher at University of Michigan and one of the authors of the study. The right strategy can mitigate dementia-related financial losses early enough to preserve the well-being of aging account holders and their families. Protecting older account holders also offers an opportunity for financial institutions to profit and attract the next generation.

“I think financial institutions can protect older adults without getting anywhere close to playing doctor,” said Joanne Hsu, research associate professor at University of Michigan.

What the research shows

The study led by researchers at Johns Hopkins Bloomberg School of Public Health, University of Michigan Medical School and the Federal Reserve Board of Governors is the first to provide large-scale quantitative evidence that the first place to look for dementia is in financial transactions.

Hsu and her co-authors analyzed credit files and dementia diagnoses of more than 81,000 Medicare beneficiaries. They compared financial outcomes of beneficiaries with and without a dementia diagnosis for up to seven years prior to a diagnosis and four years after a diagnosis.

The researchers found that those who were diagnosed with dementia showed a pattern of late and missed payments on credit accounts six years before a clinical diagnosis. Those with a lower educational status missed bill payments as early as seven years before a diagnosis of dementia. These financial symptoms didn’t show up with any other health conditions—only dementia.

“This was something that clinicians and bankers knew anecdotally,” Hsu said. “What we showed was that even in large-scale population data in which not everyone is going to eventually develop Alzheimer's disease, we're still able to see these relationships where people start making financial mistakes well before a diagnosis. We see it most strongly in terms of late payments or missed payments seven years before a diagnosis.”

Four takeaways for financial institutions

The financial warning signs of dementia likely go well beyond late and missed payments, Hsu said. She and her co-authors had access only to credit bureau data, but that data suggest that there’s a whole host of more complex financial behaviors—including erratic spending, double payments, and losses to scams and exploitation—that could be an early indicator of dementia. This has several implications for financial institutions.

Financial institutions can detect early financial warning signs of dementia. Doctors can’t see if patients are experiencing erratic financial behavior, leaving those with dementia at risk of making potentially serious financial mistakes for years before a diagnosis. Financial institutions, on the other hand, “are already in the business of looking for erratic behavior,” Hsu said. AI monitoring systems can enable financial institutions to identify changes in account holder behavior that would otherwise go undetected by clinicians, account holders and their families.

Financial institutions can alert account holders and their loved ones to changes in financial behavior. For early detection to be effective, information needs to be shared. Financial institutions could alert account holders and their joint account holders or trusted contacts to changes in account holders’ financial patterns, Hsu said. Such a solution could empower people with unbiased data and allow them to take action to avert future losses.

“I think there is the potential for additional profit for financial institutions that can mitigate losses,” Hsu said.

Financial institutions can profit from mitigating losses related to dementia. “The kinds of things that we know happen to elders with Alzheimer's disease, there's really no upper limit to the magnitude of losses that can be incurred by a person,” Hsu said. And the losses aren’t limited to just one account. The bulk of bank and credit union deposits are held by adults 60 and older, and nearly 15% of adults 70 and older are diagnosed with Alzheimer’s disease.

“I think there is the potential for additional profit for financial institutions that can mitigate losses,” Hsu said. “I don't see this proposition as an altruistic proposition for financial institutions. I think this can be mutually beneficial.”

Financial institutions can attract the next generation by protecting the older generation. If older account holders lose money to dementia-related mistakes, their adult children can be quick to blame financial institutions for not intervening. On the flip side, financial institutions that actively play a role in early detection and notification of behavior changes can prevent losses and earn the trust of account holders and their families. “You want to keep those parents and grandparents happy,” said Hsu, who noted that her longest-tenured account is at the bank where her parents have accounts.

Detecting financial warning signs is easy with Carefull

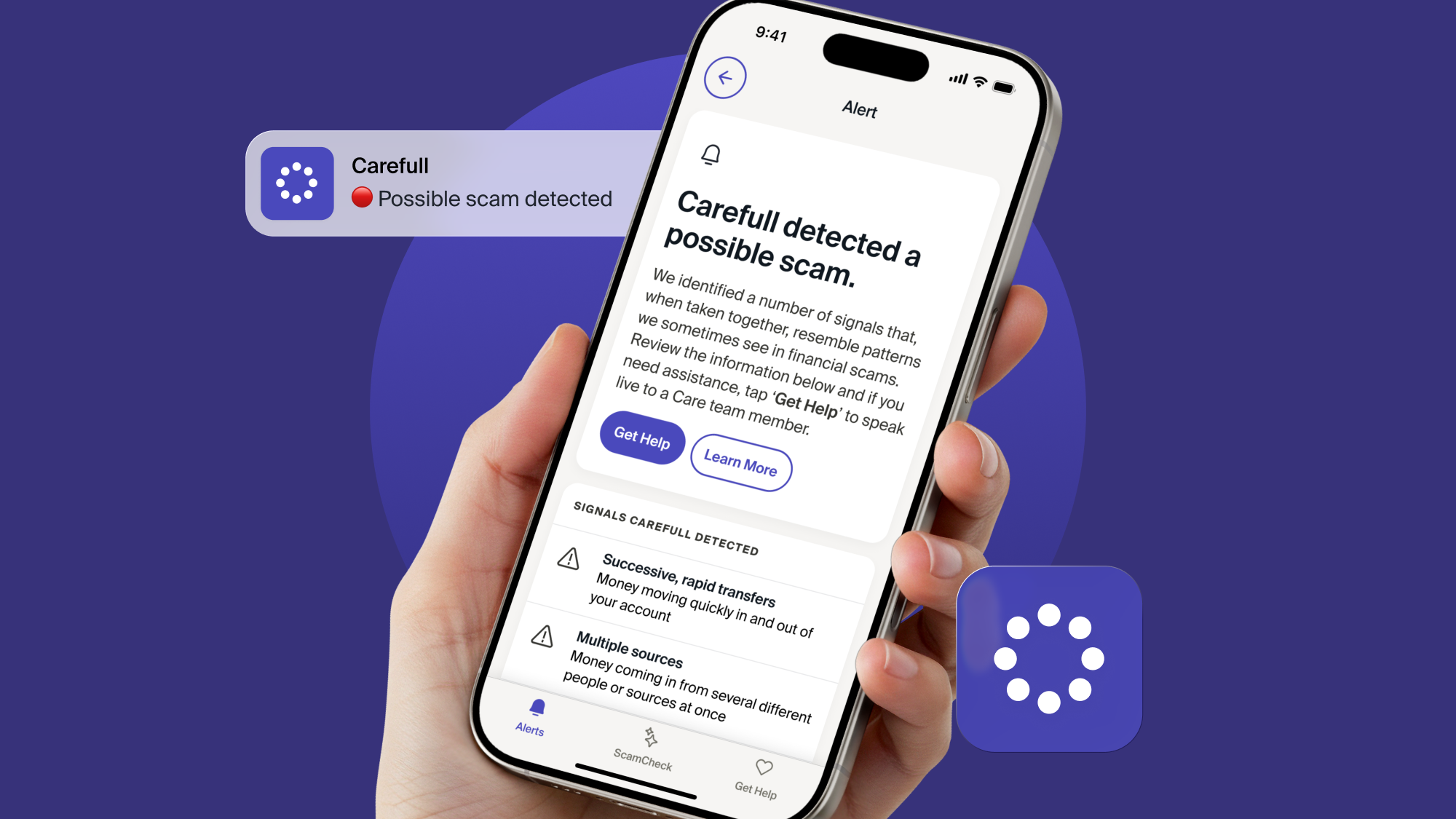

Carefull is a digital platform designed to help catch money mistakes that are common to older adults through financial account, credit and identity monitoring. Not only does Carefull’s smart monitoring technology identify late, missed and duplicate payments, but also it determines what is normal behavior to catch changes that can be early warning signs of cognitive decline.

In addition to money mistakes, Carefull detects and alerts users to unusual transactions and signs of fraud. And its Trusted Contacts feature allows aging adults to grant view-only access to family members who can act as another set of eyes on a loved one’s finances. By providing Carefull, both your older account holders and the next generation are alerted to issues that are easily brought to resolution all within the Carefull platform.

For more information on how Carefull can help your financial institution alert older account holders to small money mistakes before they become big problems, contact our team today.

3 Steps to Safer Money,

Try it Free for 30 Days

Step 1

Start your free,

no-risk trial

Step 2

Connect the accounts and cards you want protected

Step 3

Stay alerted to any

unusual activity