What Financial Institutions Need to Know About New Elder Financial Exploitation Laws

Adults 60 and older lost an estimated $61.5 billion in 2023 to elder financial exploitation, according to a report by the Federal Trade Commission. The problem is so widespread that states have increasingly been enacting laws to protect older adults.

During the 2024 legislative session, four states enacted laws specifically directing financial institutions and broker-dealers to play a role in preventing financial exploitation. And 26 states and the District of Columbia have laws mandating the reporting of suspected elder financial exploitation by financial institutions or by all adults. Plus, 40 states have laws that specifically require broker-dealers and investment advisers to report suspected elder financial exploitation and allow them to temporarily delay disbursement of funds if exploitation is suspected.

With more and more states addressing elder financial exploitation through legislation, financial institutions need to be aware of new requirements and take steps to put systems in place to protect vulnerable account holders.

New legislation impacting financial institutions and broker-dealers

Four states enacted legislation or revised existing laws in 202r to give financial institutions and broker-dealers tools to detect and prevent elder financial exploitation.

Florida: Gov. Ron DeSantis signed Senate Bill 556 into law in May 2024. It allows financial institutions to delay disbursements or transactions for 15 to 45 days from accounts of adults 65 and older or vulnerable adults if financial exploitation is suspected. Financial institutions must maintain records of delayed disbursements for at least five years and develop training programs to educate employees on elder financial exploitation. The law took effect January 1, 2025.

Kansas: In April 2024, Gov. Laura Kelly signed House Bill 2562, which requires broker-dealers and investment advisers to report suspected financial exploitation of vulnerable adults and adults 60 and older and allows them to delay disbursements 15 to 25 business days if exploitation is suspected.

Virginia: In April 2024, Gov. Glenn Youngkin signed the Virginia Senior Safe Act, known as “Larry’s Law” in honor of a Navy veteran who lost more than $3 million in an alleged wire fraud scheme. The law, which took effect July 1, 2024, allows financial institutions to let elderly and vulnerable adults submit a list of trusted people who can be contacted if financial institutions suspect financial exploitation. It also allows for training of financial institution staff to identify and report suspected financial exploitation to trusted contacts and authorities and provides immunity from liability for trained staff who disclose exploitation. The Bureau of Financial Institutions of the State Corporation Commission is required to develop and publish guidelines for such training by January 1, 2026.

Wisconsin: In March 2024, Gov. Tony Evers signed Senate Bill 628 that allows financial institutions—including credit unions, banks and insurance companies—to let adults 65 and older or disabled adults provide a list of people the financial institutions are authorized to contact if they suspect financial exploitation. Financial institutions also can notify trusted contacts and others, such as the elderly or disabled adult’s spouse and children, if financial exploitation is suspected.

All of the new laws grant financial institutions or broker-dealers immunity from civil liability for denying account holders immediate access to their money when exploitation is suspected.

Pending legislation impacting financial institutions and broker-dealers

There also is pending legislation in several states that would impact the role that financial institutions and broker-dealers would have to play in preventing financial exploitation if passed.

Illinois: Introduced in February 2024, Senate Bill 3804 amends the Adult Protective Services Act to require broker-dealers and financial institutions to report suspected financial exploitation of disabled adults and adults 60 and older.

Massachusetts: Introduced in 2023, Senate Bill 2460 and House Bill 4124 would require broker-dealers, investment advisors, bank employees and people in a supervisory, compliance or legal position with a financial institution to report suspected financial exploitation of disabled adults and adults 60 and older. They would be allowed to delay transactions for 15 days when exploitation is suspected and would be immune from civil liability for such actions.

Pennsylvania: House Bill 2064 introduced in February 2024 would allow financial institutions to report suspected financial exploitation of older adults to adult protective services, law enforcement and authorized representatives of older adults and to delay disbursements for 15 to 25 days when exploitation is suspected. Financial institutions would be immune from civil liability for such actions. The bill also authorizes the Department of Aging, Department of Banking and financial services representatives to develop a model training program for financial institutions to detect and report suspected financial exploitation.

New York: A bill introduced in the New York Senate would amend an existing law to allow broker-dealers and investment advisers to delay disbursements from accounts of adults 65 and older for 15 to 25 business days if financial exploitation is suspected.

Tools to help financial institutions protect older customers

Training employees to detect and report suspicious activity can go a long way toward combating elder financial exploitation. However, training alone won’t solve the problem and help financial institutions comply with new legislation. This is where new technology tools can help.

Senior-specific technology to monitor for fraud and exploitation

To detect and prevent elder financial exploitation, the Consumer Financial Protection Bureau recommends that financial institutions use technology to monitor for risk factors specific to older adults—which can be different from conventional patterns of suspicious activity.

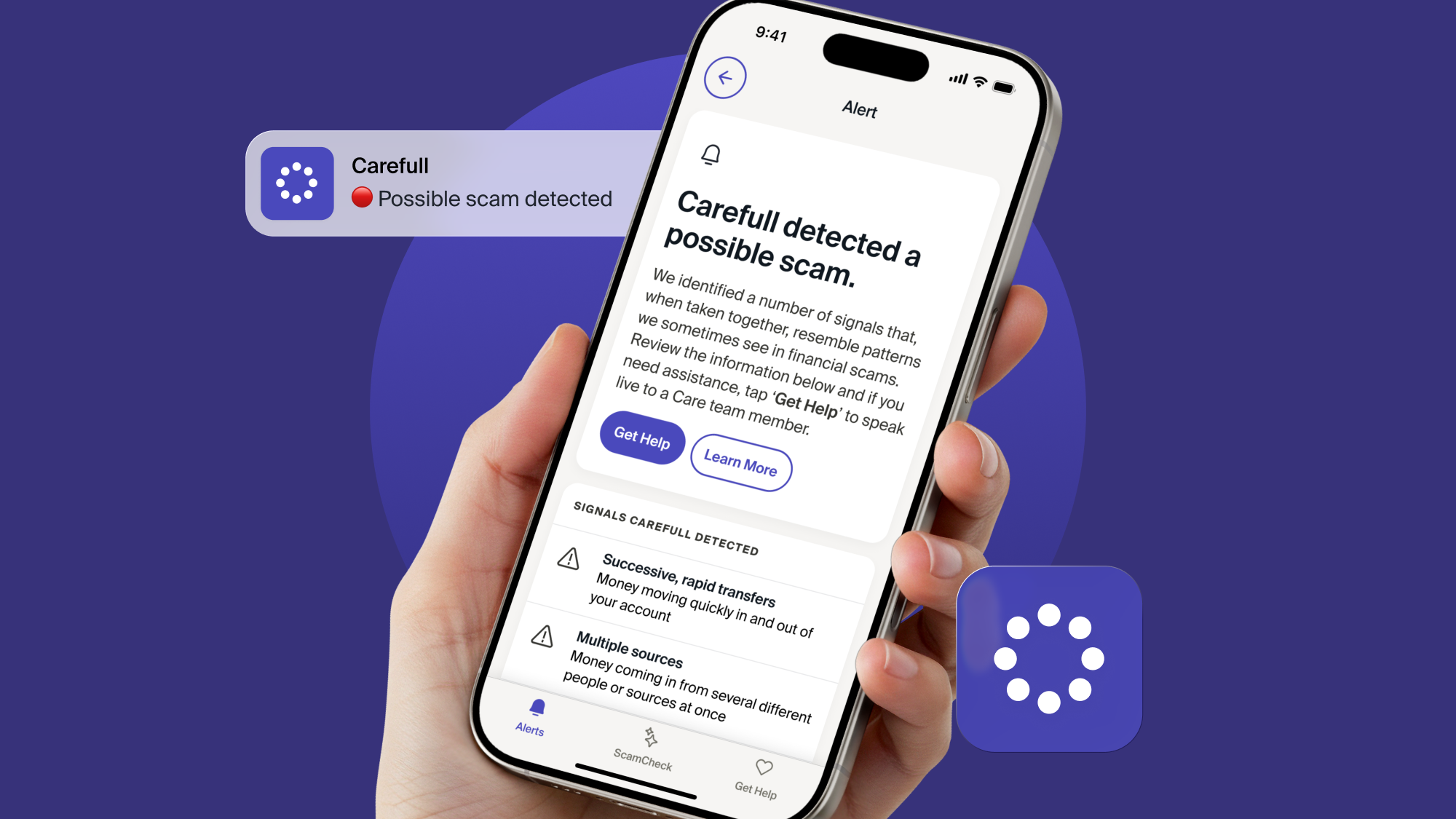

New platforms such as Carefull have been developed specifically to recognize senior-specific risks. Carefull uses advanced technology to monitor financial accounts to determine what is normal for account holders and detects changes in transactional behavior to alert them to suspicious activity.

For example, Carefull recently helped a customer at one of the banks it partners with—The Cooperative Bank (TCB) in Boston—identify fraudulent checks, including one written for $40,000. Then, a Carefull Care Agent walked the customer through steps to take to avoid future check fraud. The American Bankers Association Foundation recently named TCB a 2023 Community Commitment Award winner for protecting its older customers with Carefull.

A trusted contacts system

Existing and new laws in several states allow financial institutions to ask account holders to designate trusted contacts and to contact those trusted contacts when there is suspected financial exploitation. Financial institutions that aren’t already providing this service should. Done as part of a technology platform, it also gives banks and credit unions an opportunity to connect with those contacts and potentially bring them in as new customers or members.

Financial institutions partnering with the Carefull service have a built-in option for users to add trusted contacts to their accounts, including an ability to grant varying levels of view-only permissions. This makes it easier for financial institutions to ensure that their customers’ trusted contacts are informed about any potential suspicious activity.

Integrated content specifically for older customers

Education can go a long way toward protecting older adults from fraud and exploitation. This includes alerting account holders to scams, providing articles about staying safe online and avoiding fraud, and offering financial education video courses or webinars.

Through its team of financial journalists and experts, Carefull provides all of this content to its financial institution partners. Carefull creates co-branded microsites for its partners to feature Scam Alerts, articles and guides.

In addition to senior-specific account monitoring, content and a trusted contacts system, Carefull provides credit and identity monitoring, home title monitoring, a digital Vault for secure document and password storage, and $1 million in identity theft insurance coverage.

To learn more about how Carefull can help your financial institution protect older account holders against elder financial exploitation, get in touch with our team.

3 Steps to Safer Money,

Try it Free for 30 Days

Step 1

Start your free,

no-risk trial

Step 2

Connect the accounts and cards you want protected

Step 3

Stay alerted to any

unusual activity