What to Do When Your Identity Is Stolen

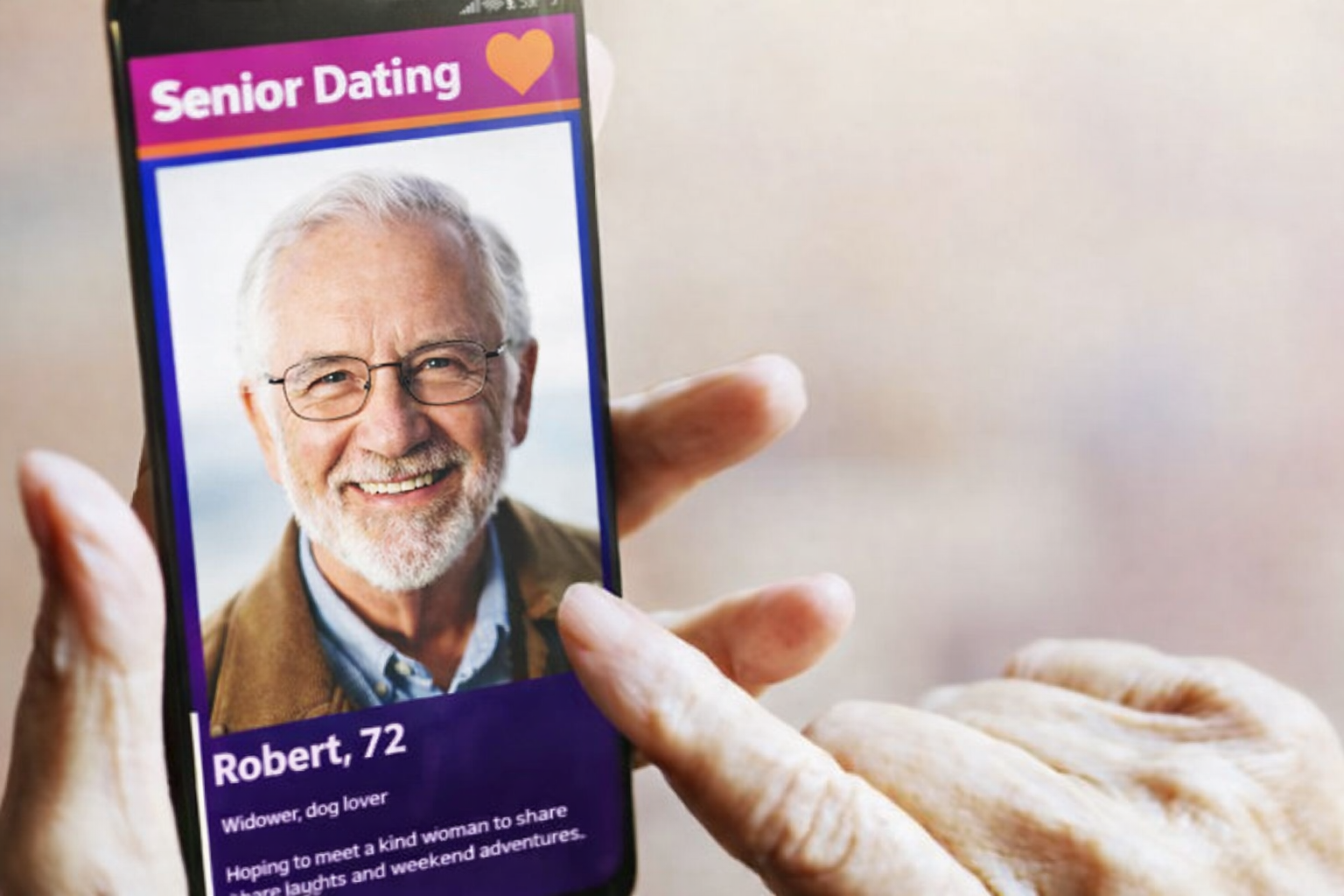

Millions of Americans become victims of identity theft every year. In fact, identity theft is the most common type of fraud reported to the Federal Trade Commission.

This crime involves thieves using people's personal information without their permission. Once identity thieves have enough information, they can do things like empty your bank accounts, run up charges on your credit card, open new accounts in your name, and steal your Social Security benefits or tax refund. Even a relatively short-term impact, such as waiting up to 90 days to have stolen money returned to your account, can be financially devastating.

It’s essential that you take steps right away to fix a case of stolen identity. The longer you wait, the more the thief can complicate your life. Here’s what you need to do.

What should you do if you’re the victim of identity theft?

Report it! Contact the Federal Trade Commission by phone at 1-877-438-4338 or online at IdentityTheft.gov.

If you do this by phone, you will not receive an Identity Theft Report from the FTC. This report is useful when dealing with creditors, the credit bureaus and law enforcement.

However, if you contact the FTC online, you get the report plus the chance to create an account with IdentityTheft.gov. The account lets you track your progress as you deal with the fallout and includes useful resources such as sample letters that you can send to creditors and others.

Should you contact the police?

It's a good idea to report identity theft to local law enforcement and get a copy of the report, especially if the following situations apply to you:

- One of the defrauded creditors requires you to submit a police report.

- The ID thief gave your name instead of their own during an interaction with law enforcement.

- You know who stole your identity, such as a relative or someone you hired to do work around your home.

When filing a report with law enforcement, bring a government-issued photo ID, proof of address (utility bill or mortgage statement/rental agreement), and a copy of your FTC Identity Theft Report. State that your identity has been stolen and you need to file a report. Then make sure to get a copy of the report.

[ Read: How Seniors Can Protect Their Credit and Identity ]

Should you report ID theft to government agencies?

Certain kinds of identity theft need to be reported to their respective agencies:

Medicare or medical insurance. If you have Medicare and thieves have used your information to file fraudulent claims, get in touch with the Medicare fraud office. With private medical coverage, contact the insurer.

Unemployment identity theft: Contact your state’s labor department.

Income tax identity theft. Get in touch with the Internal Revenue Service if someone has filed a fraudulent return in your name. You’ll likely need to complete IRS Form 14039, Identity Theft Affidavit.

Other steps to take

Place a fraud alert. This free service makes it more difficult for scammers to open new accounts using your identity because it requires lenders to verify your identity before extending credit in your name. To place the alert, contact any of the three major credit bureaus; that company will then contact the other two on your behalf.

Here are the addresses to use:

- Equifax.com fraud alert or 1-888-766-0008

- Experian.com/fraudalert or 1-888-397-3742

- TransUnion.com/fraud or 1-800-680-7289

You’ll get a letter from each credit bureau to confirm that it has they placed a fraud alert on your file. You may also choose to request an “extended fraud alert” (good for seven years) or a credit freeze (which lasts until you lift it) from each credit bureau. Both options are also free.

Freeze your credit. For a greater level of protection, use a credit or security freeze. This prevents new creditors from accessing your credit reports. You’ll need to lift the freeze if you want to open new lines of credit. But it will stop any attempts from thieves who try to open credit in your name.

If you place a security freeze on your credit report with one credit bureau, it will not report the freeze to the other bureaus. You will need to place freezes on your reports at each of the three credit bureaus.

Get your credit reports. To get free copies of your credit reports, visit annualcreditreport.com or call 1-877-322-8228. Review your reports to see if there are any transactions or accounts that were not yours.

Alert companies that your identity has been stolen. Call the businesses where fraudulent accounts or transactions have been made in your name. Ask for the fraud department, state that your identity has been stolen, and ask them to close or freeze the accounts. If you already have an account at any of these companies, change your login, password and PIN. (Note: You might need to contact them again once you’ve created an Identity Theft Report with the FTC.)

Download “Identity Theft: A Recovery Plan.” This FTC publication walks you through the steps of dealing with identity theft and explains your rights as a consumer.

[ Read: How to Protect Your Identity Online ]

How to repair the damage

This takes time, but it’s important to see things through. When taking the steps below, keep notes on whom you contacted and when, and keep all correspondence on file.

Close new accounts. Write to the fraud division of any business where the ID thief opened an account in your name. (There’s a sample letter you can use in that free FTC download, “Identity Theft: A Recovery Plan.”) You’ll be stating that someone stole your identity and that you need the company to close it. Ask the company to send you a letter confirming that the account is not yours, that you are not liable for it, and that it will be taken off your credit report. The company may ask you to provide a copy of your Identity Theft Report or complete a dispute form. When the letter arrives, keep it on file.

Remove fraudulent charges. Contact the fraud department of each business (the FTC publication has a sample letter for this, too) to list bogus charges and ask that they be removed. Request a letter once the charges have been cleared, and keep the letter on file. Again, the company may want a copy of your Identity Theft Report.

Fix your credit report. Write to all three of the major credit bureaus (the FTC publication has a sample letter for this, too). Enclose proof of identity, such as a copy of your driver’s license or other state-issued photo ID, and a copy of your Identity Theft Report. You’ll be listing what information on your credit report is the result of fraud and asking the credit bureau to block (remove) that information. After the information has been blocked, companies can’t try to collect the bogus debt.

Here are the addresses you need to use:

- Equifax, P.O. Box 740256, Atlanta, GA 30374-0256

- Experian, P.O. Box 4500, Allen, TX 75013

- TransUnion Fraud Victim Assistance Department, P.O. Box 2000, Chester, PA 19022-2000

Technology can help guard against identity theft

As the old saying goes, an ounce of prevention is worth a pound of cure. Identity and credit monitoring services exist to help you protect your identity. A service such as Carefull monitors the Internet to watch for misuse of personal and credit information. Plus, Carefull includes up to $1 million in ID theft insurance coverage. More to the point, being alerted that your identity has been stolen lets you take steps quickly to freeze your credit and avoid more damage.

[ Keep Reading: Senior Scams and How to Avoid Them ]

3 Steps to Safer Money,

Try it Free for 30 Days

Step 1

Start your free,

no-risk trial

Step 2

Connect the accounts and cards you want protected

Step 3

Stay alerted to any

unusual activity

.png)