Why Your Clients’ Children Don’t Want to Work With You

When Samantha’s father died in 2007, she knew she needed professional help managing the trust funds that were left to her by her father. “I worried that I would destroy that nest egg that was given to me,” she says.

For two years, the accounts she inherited remained under the management of her father’s investment advisor. When he changed his model and started charging higher fees, Samantha and her mom interviewed other advisors. Her mom settled on a wealth management firm with a solid reputation. The firm also wanted Samantha as a client, but she opted to work with a different advisor.

Samantha’s story exemplifies what most wealth managers know: Nine out of 10 adult children don’t choose to work with the same advisor their parents use. The question advisors should be asking is, “Why?”

Don’t assume the answer boils down to the “it’s not you, it’s me” reason often given in break-ups. In this case, the fault likely lies with the advisor. And if you’re not actively trying to figure out why your client’s children won’t stick with you, you’re missing a massive opportunity. More than $76 trillion in assets are projected to be transferred to heirs through 2045. That’s an inheritance you don’t want to let slip through your firms’ fingers.

With that in mind, consider these four key reasons why your client’s children might be opting to work with another financial advisor and what you can do to reverse this trend.

You’re not reaching out to the next generation

Don’t assume that your clients are encouraging their children to meet with you, let alone work with you. In fact, you’d be lucky if they have even told their kids about you.

Ben only learned that his parents were working with an advisor through a cryptic remark they made. “My parents simply handed me a piece of paper with a name and said, 'Call him if I'm dead,’" he says.

Kevin, on the other hand, has met his parents’ advisors, but there’s been no effort to develop a relationship. "I know them,” he says. “We've talked, but that's it."

Advisors can’t expect their clients’ children to work with them if they’re not actively reaching out to them. That contact can’t happen only after a client has died. It can’t even wait until clients need help from their kids because health issues are compromising their ability to manage money matters on their own.

Solution: Contact with clients’ children needs to begin when the relationship with the clients begins. “As soon as I meet a client, I’m having that conversation,” says John Cooper, a senior private advisor with Greenwood Capital. He has found that asking clients to recommend to their children that they meet with him is an effective way to start a relationship with the next generation.

Then, that contact with the next generation needs to be frequent—not just a one-time meet and greet. That could mean inviting young children in to introduce them to the concept of investing, providing online workshops for them when they graduate college on how to pay off student loans and start saving for retirement, then guiding family discussions as parents age about long-term care planning.

Marguerita Cheng, CEO at Blue Ocean Global Wealth, says that her older clients’ children often become clients because she actively engages with them and invites them to meetings with their parents. “The children of our clients view us as the family’s advisor, not just their parents’ [advisor],” she says.

You’re not aligned with the next generation’s financial needs

When Samantha and her mom were interviewing advisors, she could see that the firm her mom chose advocated an approach that aligned with her mother’s needs at her stage of life but not hers. Samantha was in her 30s at the time and had two toddlers. “My primary goal was to learn more and to see the funds remain stable and grow to serve as a retirement fund for myself. They emphasized gifts and jargon versus openness to educating me. They pushed big risks and big returns,” she says. “I wanted steadier performance.”

Read had a similar experience with his parents’ advisor. The advisor essentially declared that Read was a client after one meeting with him. “I worked with him for years because of that and grew my assets,” he says. “I ended up leaving him for an advisor more aligned with how I viewed money management.”

Your clients’ children have different financial planning needs than their parents. They’re not thinking about retirement withdrawal strategies. They want to know how to create a budget, pay down debt, build an emergency fund, and save for both their retirement and their kids’ college education. They want a holistic approach to financial planning, not just investment advice.

If your firm can’t meet the next generation where they are at in their financial lives, they will look elsewhere for advice.

Solution: Before reaching out to your clients’ children, find out what sort of support they need. Daniel Lash, a partner at VLP Financial Advisors, says that before he and his team invite clients’ children to meetings, they ask clients how they can assist their children. Having this information and knowing the ages of clients’ children helps Lash tailor conversations to their needs and bring them in as clients.

If you haven’t established relationships with clients ahead of wealth transfer, that doesn’t mean you have missed an opportunity to connect. One of the best ways to align with the financial needs of clients’ adult children is to support them at their greatest time of need: the passing of a parent. By assisting children with the transitioning of their parents’ estates, Lash says that he often gains those children as clients.

Identifying the needs of the next generation and adjusting your financial planning approach to support those needs will help you win over your older clients’ children.

You’re scaring away the next generation

Your clients’ children might want to work with you, but you might be sending the signal that you don’t want to work with them by requiring an account minimum that doesn’t align with their assets. “I think it is very short-sighted not to allow smaller account balances, especially when they may be the children or grandchildren of existing clients,” Cheng says. “Firms don’t want to work with people who don’t meet certain minimum asset levels and then find themselves disappointed when assets leave.”

Your fee structure might also be scaring away the next generation. Younger adults are willing to pay for financial advice, according to a survey by Fidelity Investments. But, unlike their parents, more than half said they “could be easily swayed to switch their primary financial advisor if another advisor had lower fees.”

Solution: Consider lowering your account minimum or changing your fee structure for children or grandchildren of existing clients. It might seem like a big concession to make, but the payoff could be even bigger.

Cheng of Blue Ocean Global Wealth says that one of her first clients when she became an advisor in 1999 was a 78-year-old woman, who remained a client until her death at age 92. One of the woman’s daughters and her daughter’s son also became clients. They still are clients at ages 72 and 44.

However, when Cheng took on the grandson as a client 25 years ago, he was a college student without money. She was willing to take on a smaller (practically non-existent) account to serve three generations of one family, and it paid off. “Today, he has a sizable portfolio,” Cheng says.

You’re not giving the next generation a reason to stick with you

Does your firm offer what the next generation wants? Younger adults seek whole-life advice, value diversity and inclusion, want to gain access to new investments such as ESG and cryptocurrency, and demand frictionless technology that simplifies or enhances every aspect of working with an advisor, according to the Fidelity Investments report.

Can you provide education and content that can help them navigate financial challenges they face? Do you have a succession plan and younger advisors lined up to take on younger clients and see them through to the finish line?

Are you offering the next generation something they can’t get from other firms?

Solution: Offering any or all of the above can help in winning over the next generation. However, there is something that you can offer your clients’ children that other advisors can’t: help with their parents.

Cooper of Greenwood Capital makes a point of highlighting to adult children of clients that he can help them prepare for any involvement they might have in their parents’ finances. “It really opens it up to where my niche is,” which, he says, is providing multi-generational support.

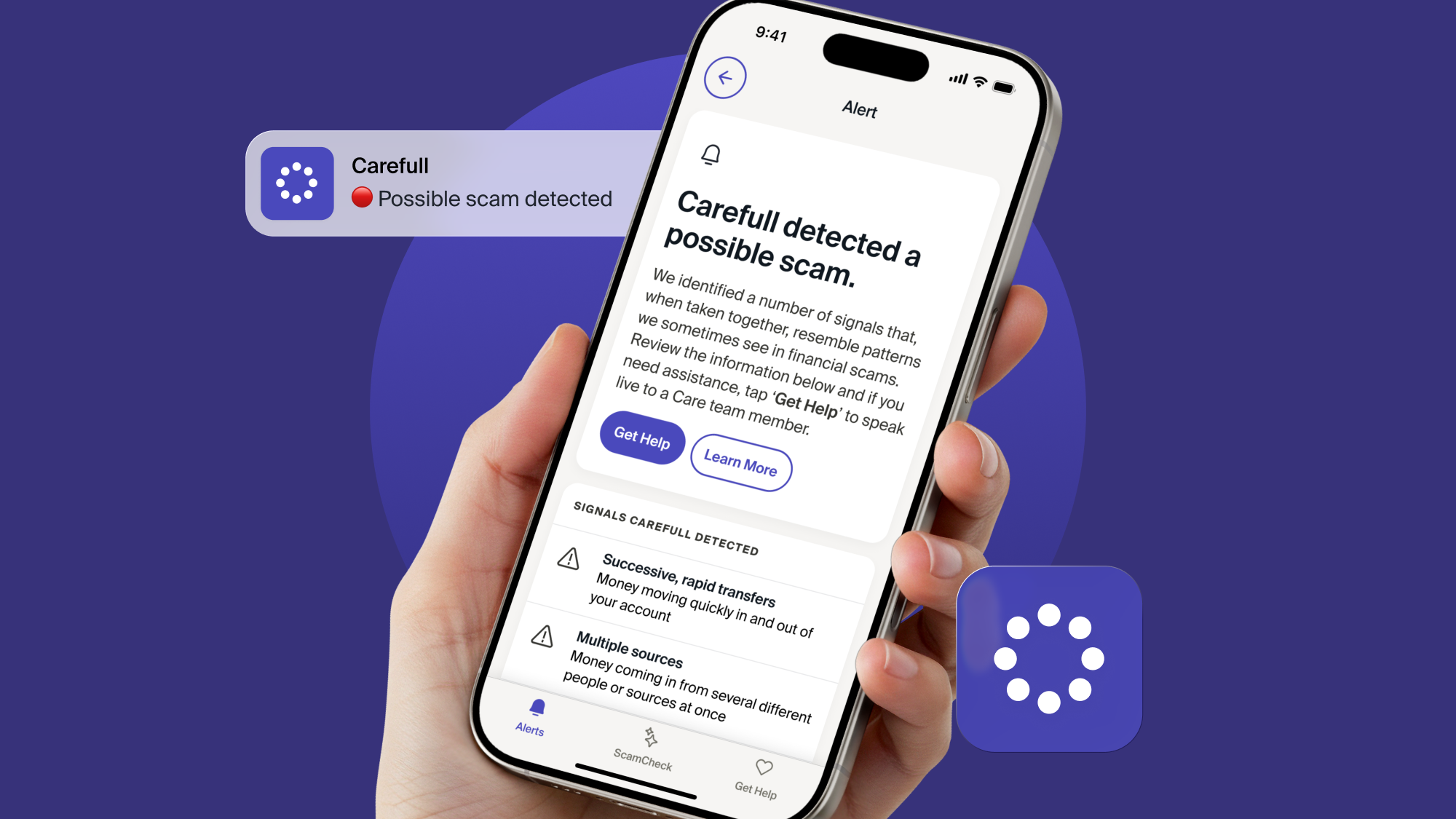

You are in a unique position to facilitate conversations between the generations. You can educate your clients’ children on responsibilities they might face as financial caregivers for parents. More importantly, you can help them protect their parents from fraud and scams, which is the biggest concern Americans have about their aging parents’ finances, according to a survey by financial safety service Carefull.

Carefull makes it easy and secure for adult children to be a second set of eyes on their parents’ finances through its safe money monitoring platform and Trusted Contacts feature. Carefull partners with wealth managers to provide their older clients with this much-needed protection and to create a bridge to their younger family members.

To learn more about how to connect with clients’ children and bring them in as clients ahead of wealth transfer, download our guide to Leveraging Carefull’s Trusted Contacts Feature to Generate New Client Leads .

3 Steps to Safer Money,

Try it Free for 30 Days

Step 1

Start your free,

no-risk trial

Step 2

Connect the accounts and cards you want protected

Step 3

Stay alerted to any

unusual activity